July

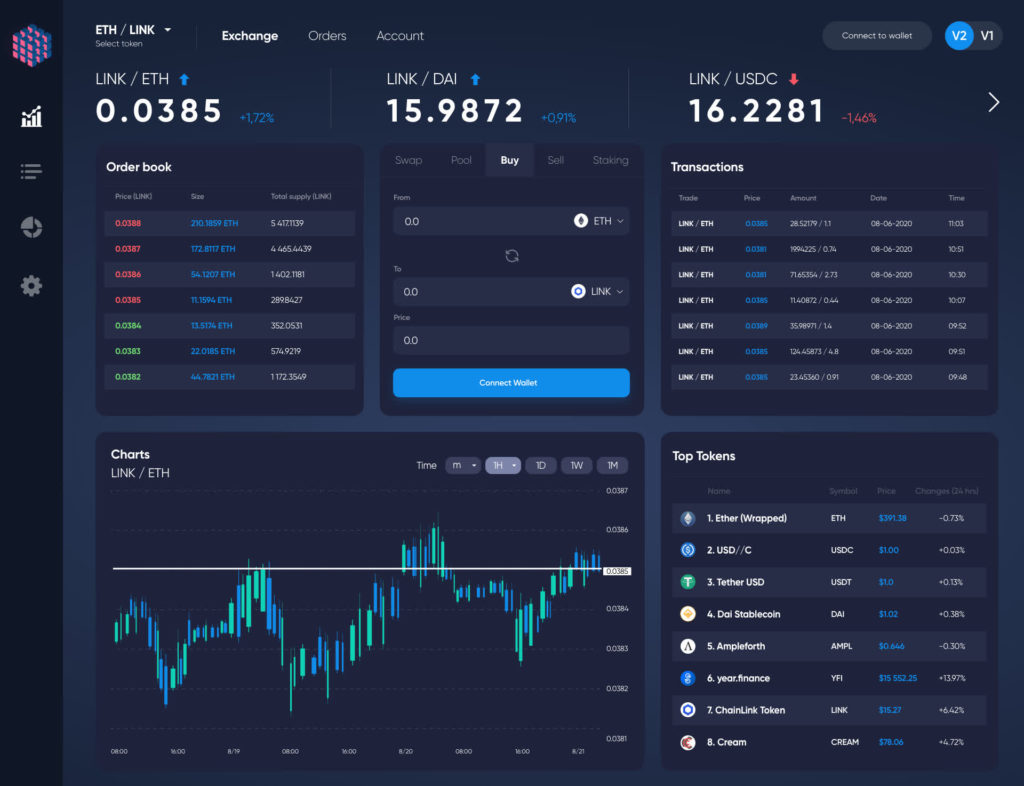

Development of prototype, frontend, idea formation and market research.

August - September

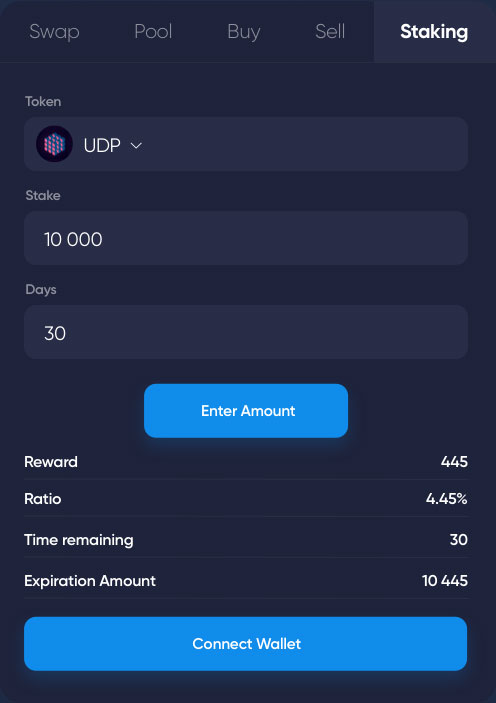

UDP private sale and token distribution.

September

Technical and business documentation. Whitepaper presentation.

October

Launching and testing the beta version.

November

Launching the full version of the project and fully introducing the product to the market.